401k to roth ira rollover calculator

The easy answer to your second question is again yes you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401 k. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

. In fact its an. 10 Best Companies to Rollover Your 401K into a Gold IRA. Make a Thoughtful Decision For Your Retirement.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Convert 401K To Roth Ira Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts. Roth Conversion Calculator Methodology General Context.

The Roth 401 k allows contributions to. With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Protect Yourself From Inflation.

Below the leading place for financial education Im mosting likely to discuss three of the most effective Roth IRA. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA.

401K To Roth Ira Conversion Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA. Traditional or Rollover Your 401k Today.

Schwab Has 247 Professional Guidance. Roth IRA Conversion Calculator. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

This calculator will show the advantage if any of converting your pre-tax 401 k to a Roth 401 k. Well walk you through the important considerations before initiating a Roth IRA conversion. Ad Open an IRA Explore Roth vs.

A 401 k can be an effective retirement tool. Ad If you have a 500000 portfolio download your free copy of this guide now. Browse Get Results Instantly.

This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. Roth Conversion Calculator Methodology General Context. This calculator will compare the consequences of taking a lump-sum distribution of your 401 k or IRA versus continuing to save it in or roll it into a tax.

A Roth IRA is entirely ineffective if you dont spend the money in your Roth IRA. Use this Roth IRA rollover calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same funds at retirement if. Your IRA could decrease 2138 with a Roth.

Ad Learn More About American Funds Objective-Based Approach to Investing. It Is Easy To Get Started. 401 k IRA Rollover Calculator.

Both are tax-advantaged retirement accounts but there are differences between the two. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Many new investors wonder if they should invest in a 401k or Roth IRA.

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Calculate your earnings and more. Ad Search For Info About 401k rollover to roth ira.

Ad Understand Your Options - See When And How To Rollover Your 401k. Does converting to a Roth IRA make sense for you.

How To Rollover An Ira To 401 K District Capital Management

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Roth Conversion Q A Fidelity

The Average 401k Balance By Age Personal Capital

Roth Ira Conversion Calculator Excel

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

5 Times A Roth 401k Conversion Is A Good Idea Above The Canopy

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

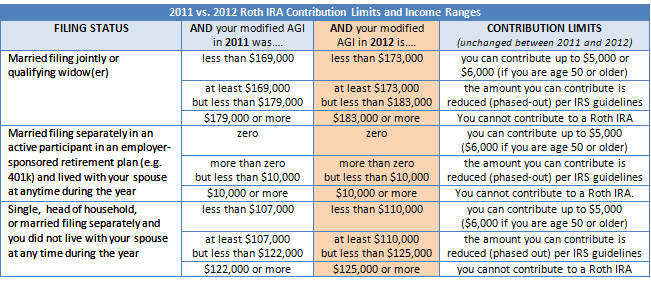

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

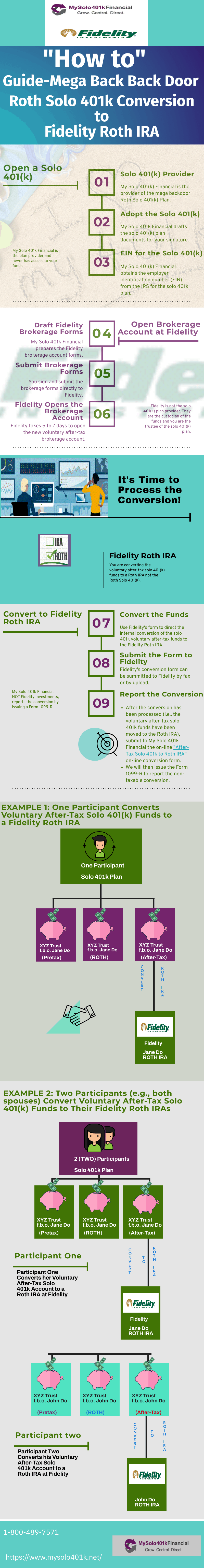

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira Conversion Ira

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

Traditional Vs Roth Ira Calculator

The Ultimate Roth 401 K Guide District Capital Management

Traditional Vs Roth Ira Calculator